Entrust Your Case to a Professional

LTW Law Firm – Certified Attorney-at-Law and Tax Advisor

Legal and tax advisory services for individuals, entrepreneurs and companies. Tax optimisation, disputes with tax authorities, criminal and fiscal-criminal cases, civil matters. Tax Advisor – Warsaw. Attorney-at-Law – Warsaw.

About Me

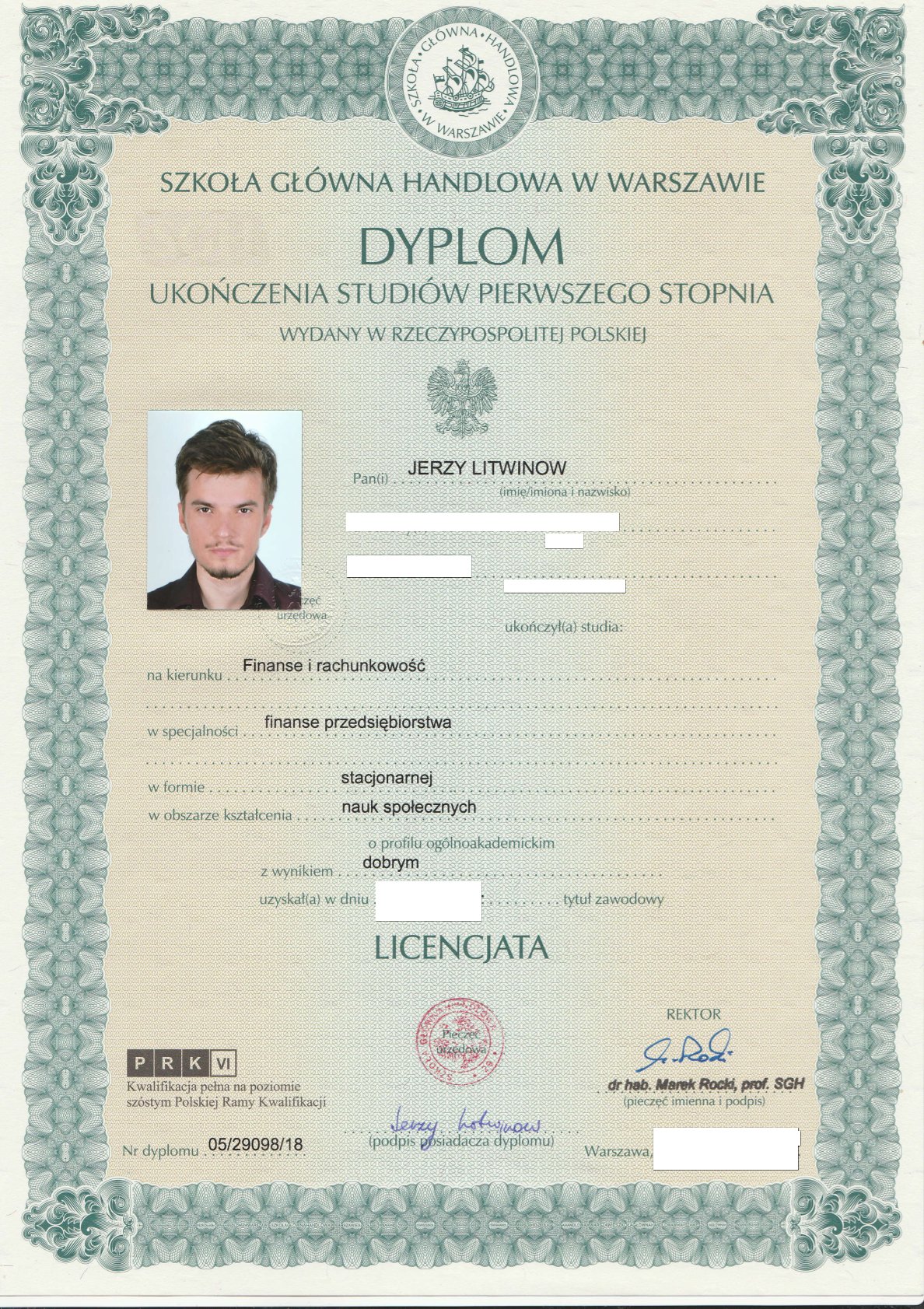

I am the owner of LTW law firm and a licensed tax advisor, a member of the Warsaw Bar Association and the National Chamber of Tax Advisors. I specialise in tax advisory, legal support for businesses, as well as civil, criminal and administrative matters.

I have many years of professional experience gained in the largest Polish law firms, as well as in the Ministry of Finance. My firm supports clients in Polish, English, Spanish, Russian, Ukrainian and Belarusian.

I am a graduate of the five-year Law Faculty at the University of Warsaw (Uniwersytet Warszawski) and the five-year Faculty of Finance and Accounting (specialisation: Taxation) at the SGH Warsaw School of Economics (Szkoła Główna Handlowa). I studied Spanish tax law at the Complutense University of Madrid (Universidad Complutense de Madrid).

My knowledge of taxation, supported by practical experience, allows me to help you navigate complex regulations and offer solutions tailored to the individual needs of each Client. As a member of the Bar, I represent clients in administrative, criminal, fiscal-criminal and civil proceedings – under the terms set out in the Polish Law (Prawo o Adwokaturze).

My team also includes attorneys-at-law with many years of experience in criminal, commercial and administrative cases.

You can verify me in the official registers at:

Dual Qualification

Having both an attorney and a tax advisor in one place means reduced risk for you and comprehensive service that saves time and resources. My team consists of licensed attorneys-at-law (adwokat) and tax advisors (doradca podatkowy) who are professionally liable for the advice they provide and whose legal opinions are taken into account by tax authorities during inspections

Trust and Responsibility

Unlike bookkeepers or non-regulated “legal consultants”, both the tax advisor and the attorney-at-law are regulated professions under Polish law. They require specific qualifications and professional authorisation (licences).

10+

Years of experience

1

Office in Warsaw

120+

Returning clients

130+

Successfully completed cases

130+

Positive tax rulings and court decisions

+ over PLN 10

million tax saved for clients

Why Clients Choose LTW Law Firm

LTW Law Firm – Attorneys and Tax Advisors provides professional legal and tax advisory services in line with the highest quality standards. All services are delivered by licensed attorneys-at-law and tax advisors.

Response Time

We respond to initial enquiries no later than one business day after receiving a request. From start to finish, each case is handled by the same attorney/tax advisor

Fee Estimation (quotation) and Timeline

At the beginning of our cooperation, we agree a timeline and remuneration. The Firm clearly defines what is included in the agreed fee and the scope of services it covers. We develop possible courses of action with an assessment of the chances of success, costs for the client and potential consequences.

Responsibility

Attorneys and tax advisors are liable for the legal and tax advice provided as well as for the documents they draft.

Service in a Language the Client Understands

We assist clients in Polish, English, Spanish, Russian, Ukrainian and Belarusian. We respect every client, regardless of their country of origin.

Confidentiality (Professional Privilege)

Client matters are fully confidential. All correspondence with the client – including via popular messaging apps – is covered by attorney/tax-advisor professional privilege. Public authorities or other entities cannot access this correspondence or question the lawyer about circumstances related to the client’s case.

Legal and Tax Opinions

Legal and tax opinions prepared by an attorney-at-law or tax advisor are recognised by public authorities and tax offices during audits. Our attorneys and tax advisors have extensive experience in disputes with tax authorities, prosecutors and courts – we act with maximum diligence to ensure your case is resolved successfully.

Our areas of practice

We provide comprehensive legal and tax advisory services, prepare documents and legal opinions, and represent clients in tax disputes, disputes with counterparties and at the litigation stage before Polish courts.

Tax Optimisation

We advise on selecting the optimal form of conducting business and minimising the tax burden for our clients in the areas of: VAT, CIT, PIT, real estate tax, TP (transfer pricing), excise duty and customs duties. As tax advisors, we prepare tax opinions that can be used during tax inspections. We select and support the application of advantageous lump-sum tax rates (ryczałt – 3%, 5.5%, 8.5%, 12%) and the 8% VAT rate, including for beauty salons. We conduct procedures regarding the relocation of personal property (mienie przesiedlenia) without tax or customs burdens.

IP Box

We handle the entire IP Box implementation process – from preliminary analysis and obtaining a tax ruling to securing a tax refund from the tax office. We dispel myths regarding IP Box and make this relief accessible to a broader range of taxpayers.

Tax Audits and Disputes with Tax Authorities

We represent and defend clients in tax and customs disputes, security proceedings, administrative enforcement and cases involving bank account freezes. We also act for clients at the litigation stage before administrative courts.

Real Estate Tax

We are also one of the few firms that specialise in real estate tax matters, helping clients correctly determine the tax base and reduce their current tax burden.

Civil Cases – Civil Litigation

We assist clients in recovering overdue commercial debts, draft contracts and represent clients in disputes with contractors.

Family Foundations (Fundacje Rodzinne)

We specialise in creating and servicing family foundations, including from the perspective of optimising the taxation of their business activities. Thanks to the cooperation of an attorney-at-law and a tax advisor in one place, we effectively implement solutions that protect entrepreneurs’ assets.

Fiscal-Criminal Cases (KKS)

By involving both a tax advisor and an attorney-at-law at an early stage, we develop a defence strategy and effectively apply legal measures to minimise the risk of our clients being held criminally or fiscally liable.

Legalisation of Foreigners

We analyse each client’s situation and handle the process of obtaining temporary residence permits, permanent residence permits, the Polish Green Card (Karta Polaka) and other migration documents. We conduct proceedings for recognition as a citizen of the Republic of Poland and for the granting of citizenship by the President of Poland.

Tax Rulings and Binding VAT-rate Information (WIS)

We draft applications with legal argumentation in the client’s interest and represent them at all stages of proceedings before the Director of the National Tax Information (KIS) until a positive individual tax ruling or a WIS decision is obtained.

Optimisation of Taxation of Income from abroad

We determine the optimal PIT regime for seafarers, IT specialists, managers and sales professionals in the IT sector, as well as other professionals earning income from abroad (both from the EU and non-EU countries).

Customs and Excise Matters

As one of the few tax advisory firms, we specialise in customs and excise issues, assisting entrepreneurs in obtaining required permits and clarifying the correct calculation of customs duties and excise tax. We implement procedures that facilitate the import of goods into Poland.

Criminal Cases – Criminal Defence Lawyer

We represent victims of crime, as well as witnesses, suspects and defendants. Your case will be handled confidentially and in line with your expectations, with a focus on maximising your chances of success. We prepare all appeals and remedies (complaints, appeals, cassation complaints). Effective defence in criminal cases is crucial for a favourable outcome.

Corporate Legal Services

We provide ongoing legal support to companies, with particular focus on IT businesses. We draft contracts, conduct corporate reorganisations and handle disputes with contracting parties. We also represent clients in disputes with public authorities.

Controlled Foreign Companies – CFC

We analyse the obligations of clients holding shares in foreign companies (e.g. in Estonia, the USA, Cyprus, Germany) under Polish CFC rules. We assist in optimising asset structures and operational processes in foreign entities in order to minimise the risk of their classification as CFCs.

Complex Migration and Deportation Cases

We represent clients before the Border Guard, Voivodeship Offices, the Head of the Office for Foreigners and administrative courts in complex migration and deportation matters. We file complaints with the European Court of Human Rights and handle asylum, international protection and Dublin III procedures.

Legal and Tax Opinions

We prepare legal and tax opinions, signed by an attorney-at-law or tax advisor, which are taken into account by authorities and tax offices during inspections.

Client Service Model

Every case is a priority – analysis, strategy and consistent execution. Every client is important to us – we act carefully, responsibly and effectively. Consultations are offered online throughout Poland or in person at our office in Warsaw (convenient location – Rondo Wiatraczna).

Contacting the Firm

Describe your case by email, via the contact form or on Telegram.

Strategy and Assessment

We present possible courses of action together with a detailed schedule and fee estimate.

Strategy Implementation

Once the approach has been agreed with the client, we proceed to implement the requested service.

Location

Our office is located in Warsaw, but we provide the full range of services remotely throughout Poland and for international clients. Meetings may be held on site in the office or as online consultations

Warsaw

In-office meetings or online consultations

Warsaw

Aleja Waszyngtona 146, lokal 403

+ 48 737 674 301

What Our Clients Say

We build trust through results – thank you for every word of recommendation

Jerzy helped me obtain a positive individual ruling on IP Box. He demonstrated a high level of professionalism and efficiency throughout the entire process. In total, it took only about a month. Highly recommended.

Pavlo

We would like to express our immense gratitude to Attorney Jerzy for his professional assistance in resolving a complex case between a flat owner and the tax office. Thanks to his diligent approach, thorough analysis of the situation and clear guidance, we managed to clarify the matter, avoid penalties and, most importantly, keep the flat we were renting.

Yuliia Leydyk

Heartfelt thanks to the tax advisor. I would like to express my sincere gratitude for professional support in the complex process of legalising income from cryptocurrencies. Thanks to his well-considered approach and precise recommendations, I was able to prepare my tax documentation correctly and avoid misunderstandings with the tax office.